Who’s to Blame for High Latency? When It’s Your Broker’s Fault (And When It’s Not)

Trading happens at near-light speeds, and low latency is a critical component for efficiently trading in the marketplace. With the speed of today’s electronic trading, abrupt pricing fluctuations can happen in microseconds. To compete in this hypercompetitive arena, a...

So, How Do You Measure the High-Frequency Trading Arms Race?

Recent BIS study estimates from their U.K. data that global market for latency arbitrage is worth about $5 billion annually Different “finish line” message data may reveal more arbitrage information Competitor groups may be smaller than you think Latency arbitrage has...

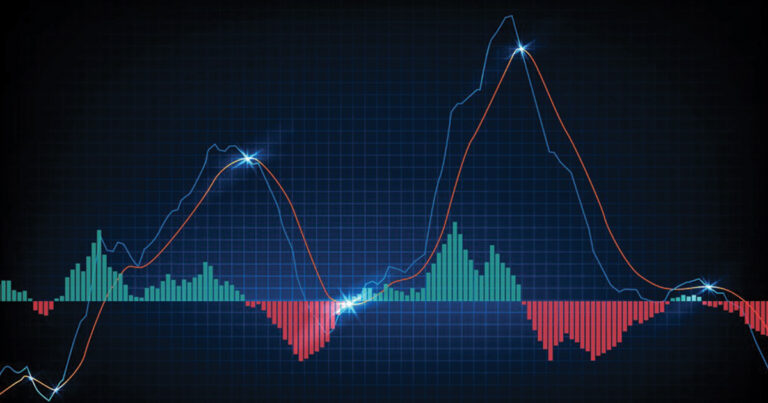

How to Use the MACD Indicator

The Moving Average Convergence Divergence (MACD) indicator helps identify trends in a security’s price direction. Spotting potential price trends depends on more than intuition or luck. Traders rely on research and indicators to help identify trends as early as...