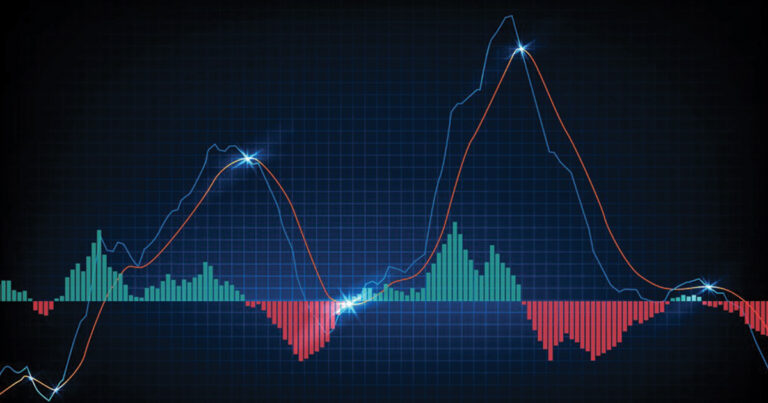

How to Use the MACD Indicator

The Moving Average Convergence Divergence (MACD) indicator helps identify trends in a security’s price direction. Spotting potential price trends depends on more than intuition or luck. Traders rely on research and indicators to help identify trends as early as...